Congress passed a record $2.2 trillion economic stimulus bill to help our nation recover from the coronavirus crisis that was signed into law on March 27th. We want to provide SEIU members with an overview of how it could impact us here in Oregon.

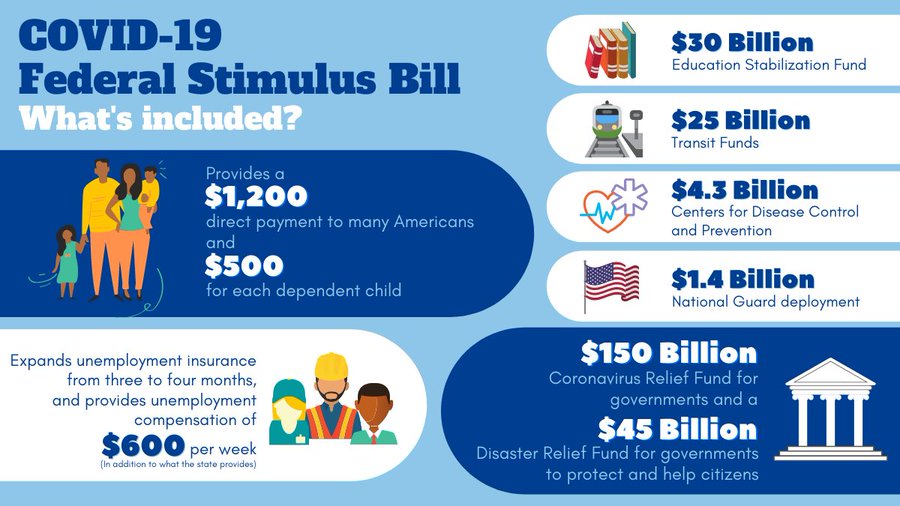

- One-time payments of $1,200 per adult and $500 per child for individuals earning less than $75,000 and couples earning up to $150,000 annually. Individuals who earn $99,000 and couples earning $198,000 won’t receive payments. You can calculate what you could expect here.

- Unemployment benefits will increase up to $600 per week and expand to include part-time and self-employed workers for a total of 39 weeks.

- It increases food assistance by providing an additional $24.3 billion for child nutrition programs and the Supplemental Nutrition Assistance Program (SNAP).

- State and local government social services will receive $150 billion.

- $12 billion in housing assistance and protects tenants from eviction.

- Small businesses will receive up to $350 billion in loans which could turn into grants.

- Large industries will receive up to $425 billion in loans.

The bill still has some weak spots: for example, it requires airlines receiving assistance to maintain employment levels as of March 24 “to the extent practicable,” rather than making that a firm commitment. However, it does strengthen corporate accountability. One of our biggest concerns with earlier versions of the bill was that there was little accountability to corporations who would receive federal funding during this crisis. The final version strengthens guardrails on lending and adds transparency requirements.

Oregon is working on our own coronavirus response legislation and we still have an opportunity to make sure that our state focuses our recovery on workers. So, please, contact your legislators today and tell them that Oregon must protect ALL workers!

You can see a more detailed breakdown here. Here are some other major aspects of the stimulus broken down by sector:

Airports

- Significant protections for airport workers. The legislation includes $3 billion in financial assistance to airline contractors which will preserve the jobs of 235,000 contracted airport workers, $25 billion to airlines and $4 billion to cargo carriers for the continuation of payment of employee wages, salaries, and benefits. This agreement contains layoff protection — an air carrier or contractor must certify that they shall refrain from conducting involuntary furloughs or reducing pay rates and benefits until September 30, 2020.

Healthcare Providers

- $150 billion for hospitals and other healthcare providers. The funds will address immediate capacity needs including personal protective equipment, a significant investment in pharmaceutical research and development for vaccines and therapies, and expanded access to treatment through changes in the law regarding providers and insurers and boosted Medicare and Medicaid payments.

School Employees

- $30.75 billion in emergency support to local school systems and higher education. Additional funding will allow institutions to continue to provide educational services to their students and support the on-going functionality of school districts and institutions. These funds can be used in a variety of ways, including funding distance learning while schools are closed, as well as cleaning and sanitizing school buildings.

Child Care

- Assistance for child care providers and frontline workers who need child care. Child Care workers will benefit from the $3.5 billion increase for the Child Care and Development Block Grant (CCDBG) program including provisions allowing for continued payments to providers and their staff during closures or enrollment declines. States are also authorized to use funds to provide child care assistance to healthcare workers and other essential workers. The legislation also provides $750 million for Head Start.

Public Transportation

- $25 billion in aid to our nation’s transit systems. Funds will help protect public health and safety while ensuring access to jobs, medical treatment, food, and other essential services.

Accountability to Ensure Corporations Receiving Assistance Invest in Working People

- Restrictions on any increases to executive compensation, dividend payments to stockholders and on harmful financial practices used by executives to boost the price of their companies’ stock.

- Protect Collective Bargaining Agreements.

- Prohibition on businesses controlled by the President, Vice President, Members of Congress, and heads of Executive Departments getting loans or investments from Treasury programs.

- Requires mid-size businesses with 500 to 10,000 employees that apply for certain direct loans are required, “to make a good-faith certification that the recipient will remain neutral in any union organizing effort for the term of the loan.